Banking Services

Plastic Card Technology

=====================

Until the 1960s, most financial transactions were based on paper (cash and checks).

Today , the majority are electronic, and of these, a large proportion involve plastic card.

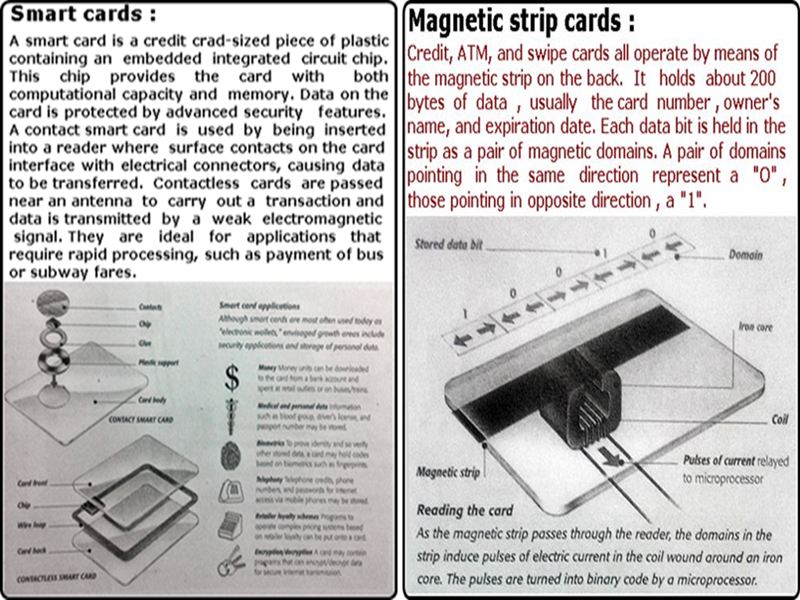

These are two main types of cards :

1) cards with a magnetic strip , which include ATM (automated teller machine) , credit, and

2) swipe cards , and the more sophisticated "smart" cards.

Both types are also used for security purposes.

The first step in any card transaction is validation of its use by the card holder.

With magnetic strip cards, this process is performed by a remote computer once

it receives the card number from the ATM or other card reader. For a swipe card

giving entry to a gym, the only necessary checks may be that the card has not

expired or been reported stolen. For a credit card, an additional check may be

made that the user has not exceeded a credit limit. The user must also supply a

signature. For an ATM card, the user enters a PIN (personal identification number)

before transactions can occur. Smart cards differ in that the process of approving

transactions is performed by a program on the card itself, the card knows the user's

PIN . Smart cards are designed to hold confidential data in a secure form. In contrast,

the data on a magnetic strip card is usually not secret at all.

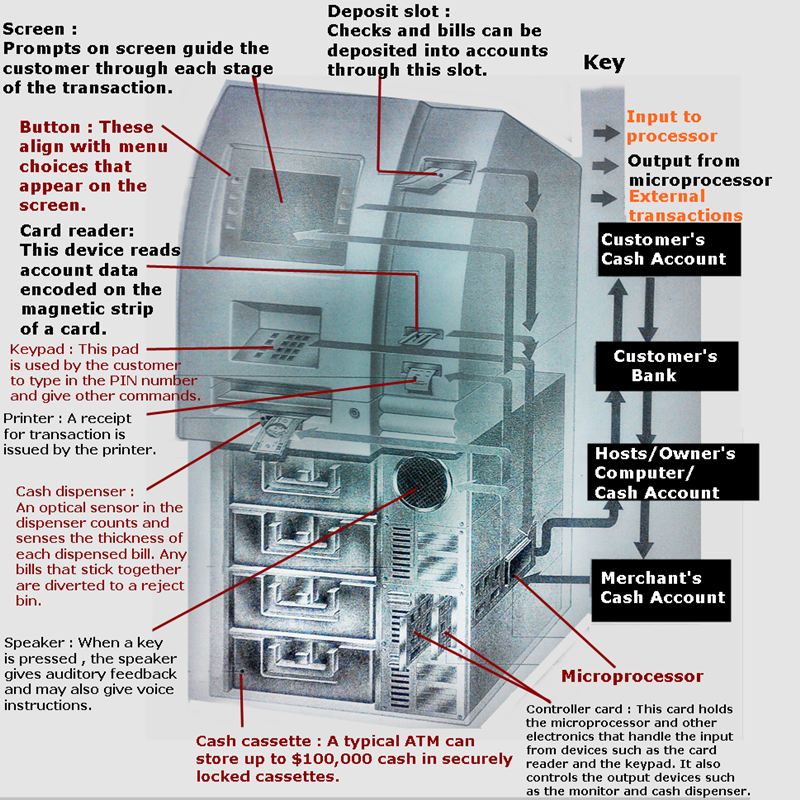

ATM Machine (Automated Teller Machine)

======================================

A fully featured ATM can dispense bills, take deposits, answer balance inquiries , and

handle fund transfers. The ATM's operation is controlled by its microprocessor, but tasks

such as customer identification , account balance verification, and the issuing of transaction

instructions are handled over a cable link by a computer belonging to the ATM owner (host).